do nonprofits pay taxes on utilities

Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases.

Profit And Loss Template For Excel Profit And Loss Statement Statement Template Profit

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

. Enjoy flat rates with no-surprises. The research to determine whether or not sales. Most sales of food and beverages to governments are taxable.

In short the answer is both yes and no. Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from. Yes nonprofits must pay federal and state payroll taxes.

Services to General Public Taxable If your. Yet the parent Pepco Holdings did not pay income taxes during. Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax.

We never bill hourly unlike brick-and-mortar CPAs. Nonprofit and Exempt Organizations Purchases and Sales. Do nonprofits pay payroll taxes.

Sadie is ready to get up to speed on paying payroll taxes. House Bill 582 which legislates the tax exemption. Wheres My Income Tax Refund.

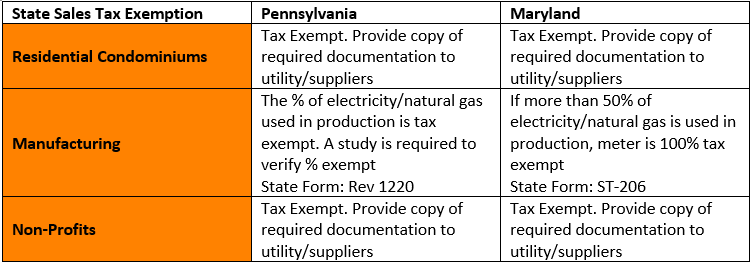

Property TaxRent Rebate Status. Most nonprofits do not have to pay federal or state income taxes. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. However this corporate status does not. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain.

We never bill hourly unlike brick-and-mortar CPAs. The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. 501c12 Tax exempt Income from memberships to 501c12 co-op utility providers is not considered UBTI and is tax exempt.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Pepco collected nearly 546 million from customers to cover its income tax bill for the years 2002 through 2004. Do nonprofits pay taxes.

Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing. Your recognition as a 501c3 organization exempts you from federal income. Do nonprofit organizations have to pay taxes.

Pennsylvania Department of Revenue Tax. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses. However here are some factors to consider when.

Many but not all nonprofits are considered tax exempt which means that they are not required to pay federal corporate. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on regulated. But the one tax exemption that even nonprofits sometimes find.

While most US. However there are some situations where sales tax is not due. Enjoy flat rates with no-surprises.

Sales to Government and Nonprofits. For assistance please contact any of the following Hodgson.

Providing Essential Utility Services During Covid 19 Payments And Relief

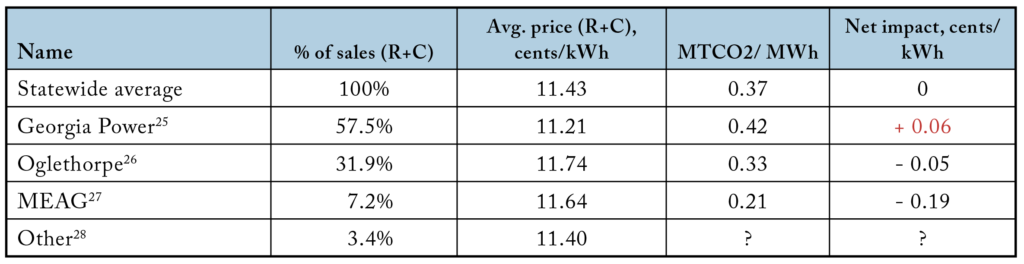

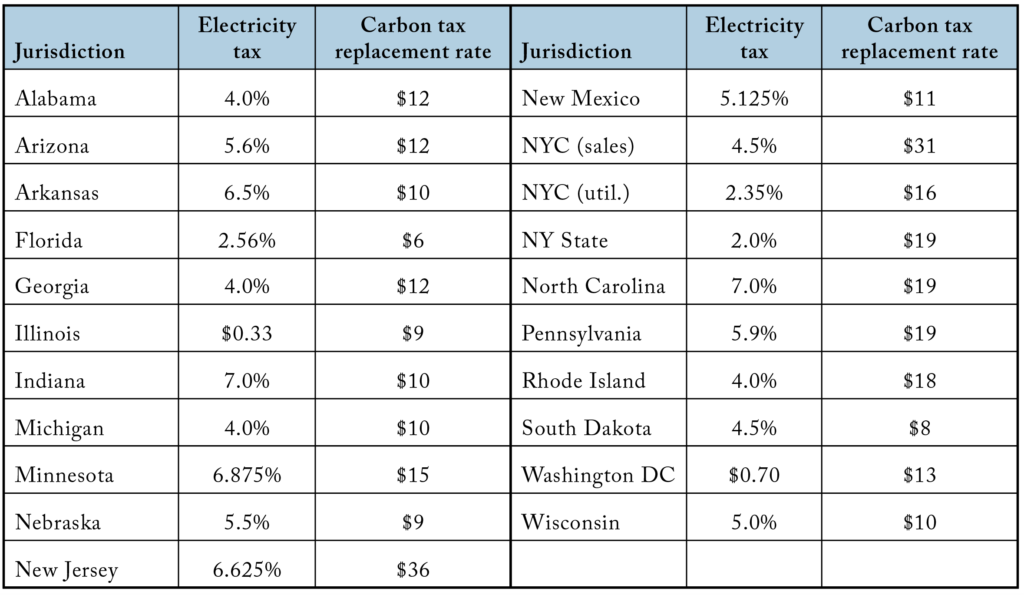

Tax Exemptions For Energy Nania

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Worksheet Template

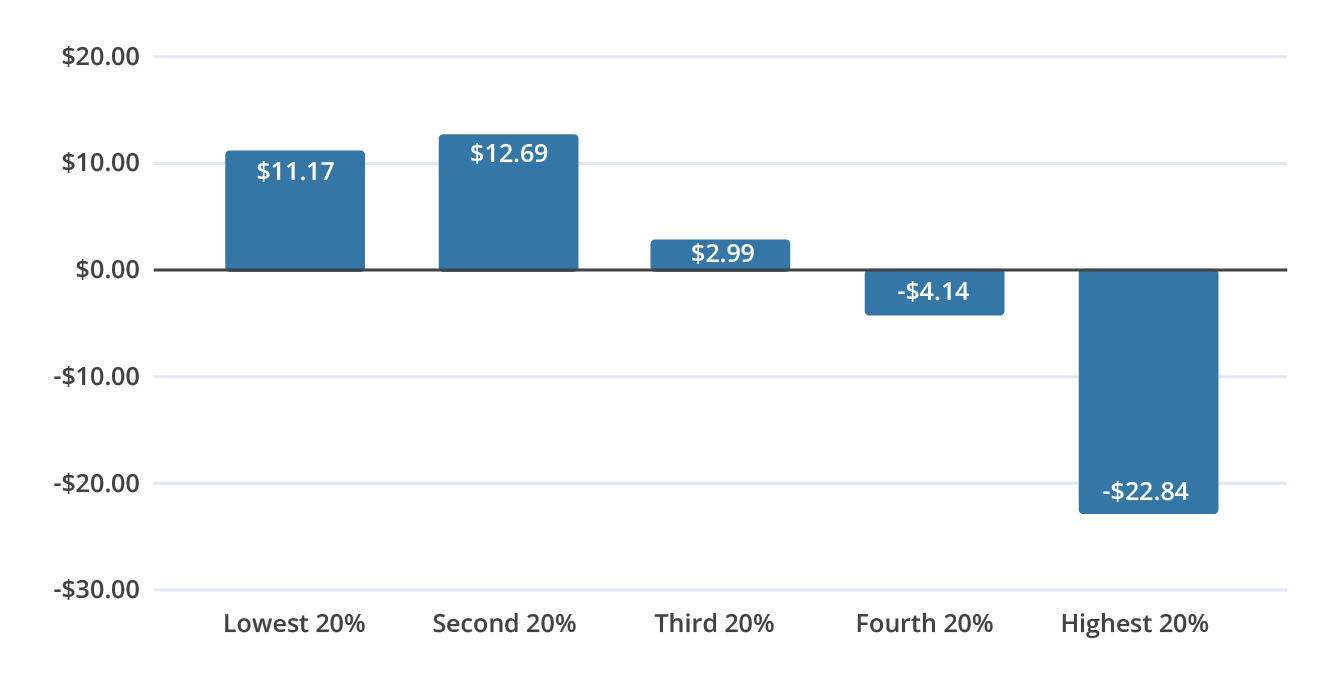

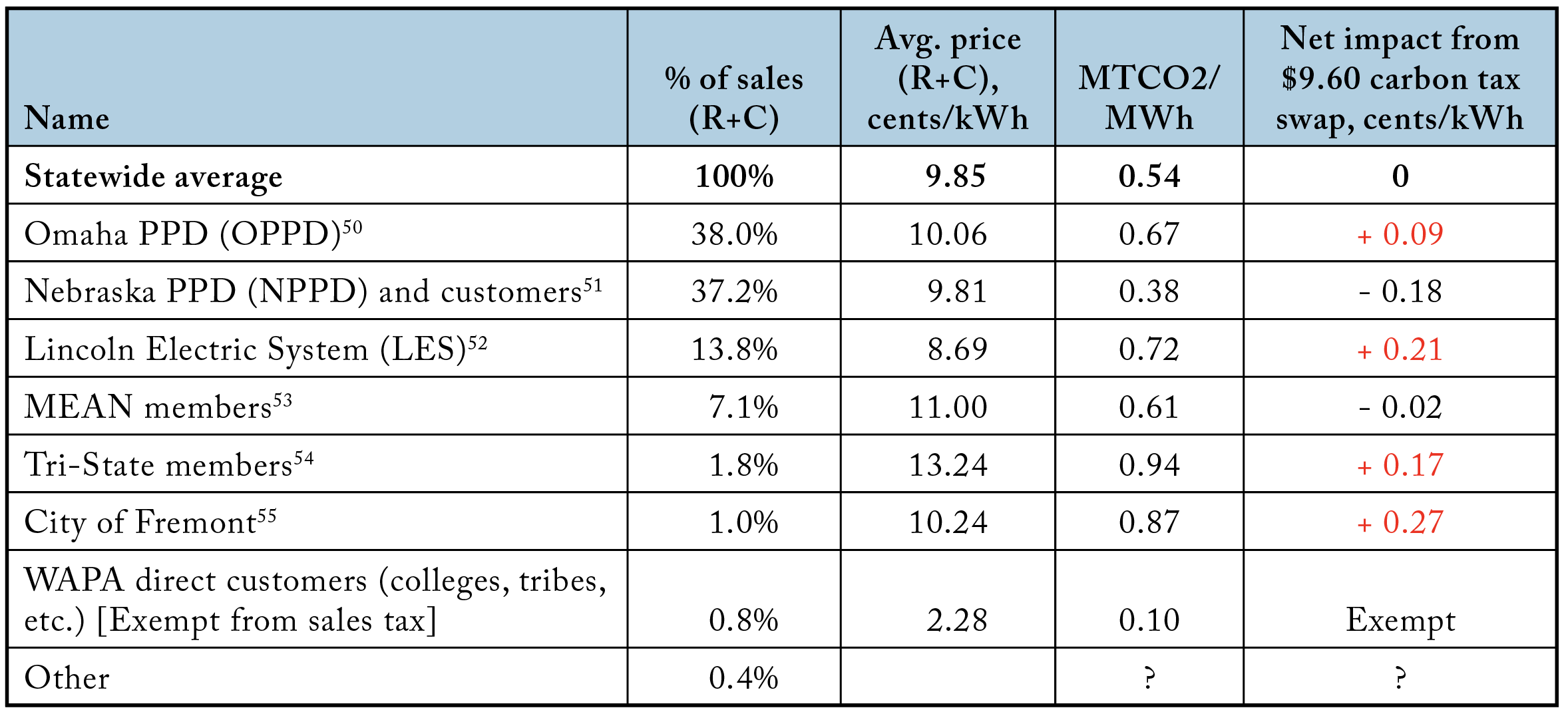

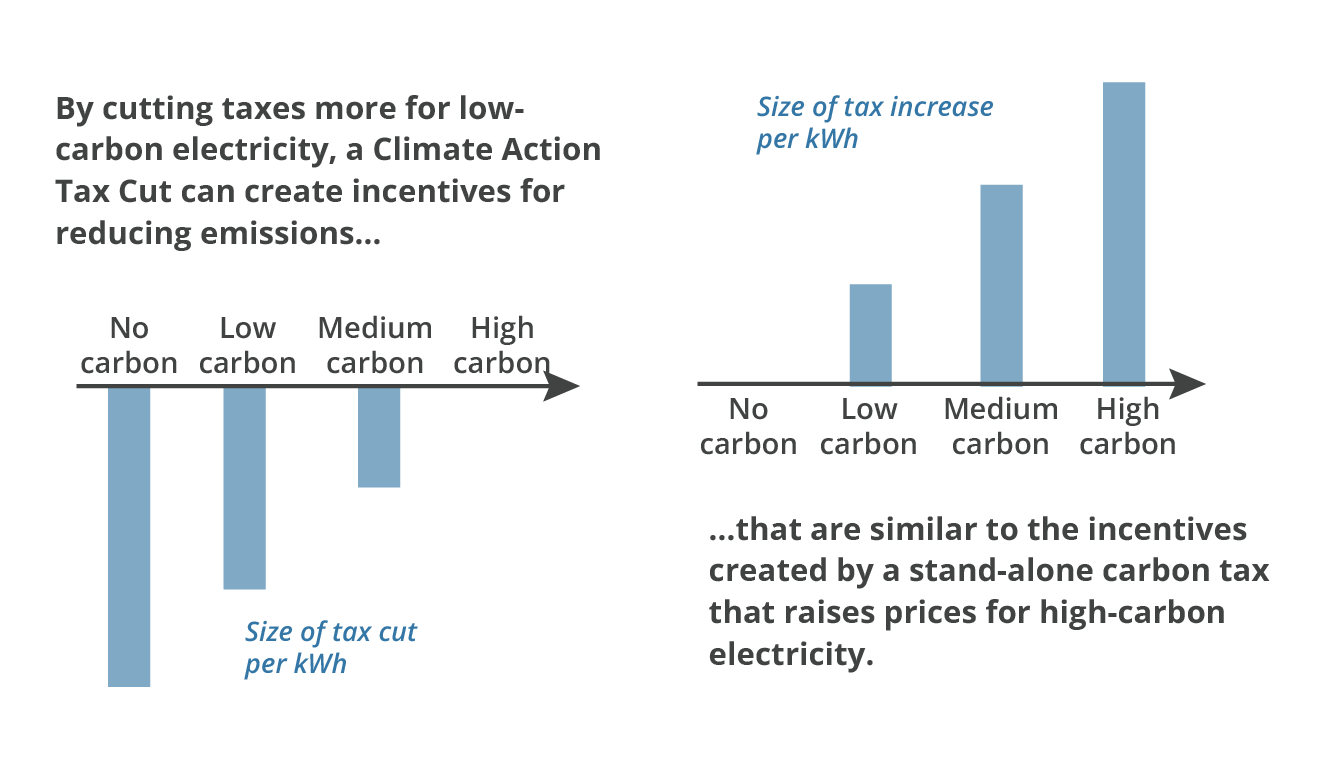

Carbon Taxes Without Tears The Cgo

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Carbon Taxes Without Tears The Cgo

Free Cash Flow Forecast Templates Smartsheet Cash Flow Smartsheet Free Cash

What Utilities Should Consider When Evaluating Payment Kiosk Vendors Citybase

Tax Exemptions For Energy Nania

What Are Functional Expenses A Guide To Nonprofit Accounting

Five Rules For Buying A House And How Far You Can Bend Them Buying A New Home Life Hacks Home Improvement

Carbon Taxes Without Tears The Cgo

/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)

7 Things You Didn T Know Affect Your Credit Score

What Is A Nonprofit Definition And Types Of Nonprofits Build A Business 2022 Shopify New Zealand

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Explanation Components And Examples

Carbon Taxes Without Tears The Cgo

Overhead Vs Operating Costs Napkin Finance

Carbon Taxes Without Tears The Cgo

Revenue Projection Spreadsheet Cash Flow Statement Statement Template Cash Flow